Individual Tax Update

What You Need to Know Now About Key Changes, New Deductions, and 2025 Tax Return Considerations

As we kick off 2026, here are the most important individual tax developments. This update highlights inflation-adjusted amounts, new deductions under recent law changes, reporting requirements, and early-year planning actions. It also includes items that may affect preparation of your 2025 federal tax return.

CREATE AN IRS ONLINE ACCOUNT

Individual taxpayers may now set up an online account with the IRS. An IRS Online Account at irs.gov gives you secure access to:

Tax transcripts and filing history

Information returns (Forms 1099, W-2)

IRS notices and correspondence

Payment activity and balances

Credits and advance payments

Identity protection tools

Approve tax professional authorizations

We recommend all individual taxpayers set up an account. You may do so here:

INFLATION-ADJUSTED AMOUNTS FOR 2026

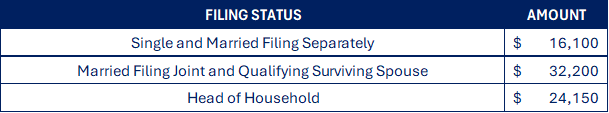

Standard Deduction:

For tax year 2026, the standard deduction amounts are shown in the table. These amounts are adjusted annually for inflation.

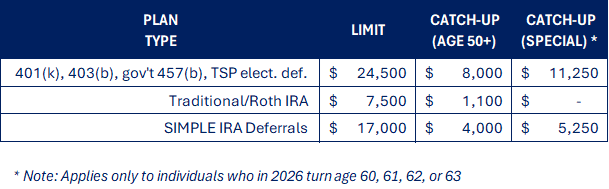

Retirement Plan Limits:

For tax year 2026, retirement plan contribution limits are shown in the table.

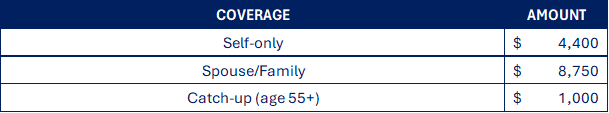

Health Savings Accounts (HSAs)

For tax year 2026, contribution limits to Health Savings Accounts (HSAs) are shown in the table.

Estate and Gift Tax Exemptions

For tax year 2026, the estate and gift tax exemptions are shown in the table. These are adjusted annually for inflation.

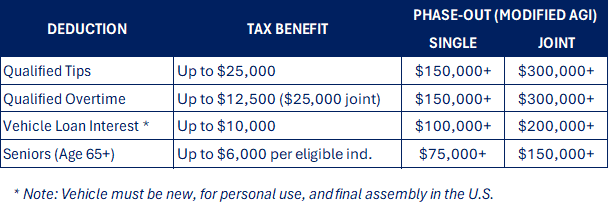

NEW TAX DEDUCTIONS FOR TAX YEARS 2025–2028

Recent law created four major above-the-line deductions, claimed on the new Schedule 1-A (Form 1040). These deductions are temporary for 2025 through 2028 and have specific eligibility rules.

DIGITAL ASSETS & VIRTUAL CURRENCY REPORTING

The IRS expanded reporting for digital assets. For 2025 transactions, brokers must report gross proceeds from sales and exchanges of digital assets (including cryptocurrencies, stablecoins, and NFTs) on the new Form 1099-DA, which you may receive in early 2026.

You must report all taxable digital asset transactions, even if you do not receive a Form 1099-DA.

For 2025, brokers are not required to report cost basis on Form 1099-DA, so maintain detailed records of your cost basis.

EARLY-YEAR TAX PLANNING OPPORTUNITIES

Consider these items in early 2026:

Review federal withholding and estimated tax payments considering new deductions and updated limits.

Maximize retirement plan contributions using updated 2026 limits.

Fund HSAs throughout the year if eligible.

Consider timing of income and deductions based on your expected circumstances.

Revisit estate planning strategies considering the current exclusion amounts and potential future law changes.

STAY CONNECTED

If you have questions about these changes or would like assistance with your IRS Online Account or 2026 planning strategies, please contact our office.

Thank you for trusting us with your tax and financial needs.