Subscribe to our newsletter

Subscribe to our newsletter

Individual Tax Update

What You Need to Know Now About Key Changes, New Deductions, and 2025 Tax Return Considerations

As we kick off 2026, here are the most important individual tax developments. This update highlights inflation-adjusted amounts, new deductions under recent law changes, reporting requirements, and early-year planning actions. It also includes items that may affect preparation of your 2025 federal tax return.

Business Tax Planning

Year-End Business Tax Planning Strategies

As the end of the tax year approaches, now is an ideal time to consider strategies that may reduce your business’s 2025 federal tax liability. The recent One Big Beautiful Bill (OB3) extended or enhanced several taxpayer-friendly provisions. Below are opportunities to evaluate before year-end.

MPC Partner Named as Top 200 CPA in America by Forbes

Forbes has named one of our tax partners, Alex Lehmann one of America’s Top 200 CPAs.

Each year, Forbes highlights exceptional CPAs who demonstrate excellence in their field, provide outstanding service to their clients, lead with integrity, and contribute meaningfully to the accounting profession and their communities. Honorees represent a wide range of specialties, firm sizes, and regions.

One Big Beautiful Bill Act - Summary of Tax Provisions

The huge tax package in the One Big Beautiful Bill Act became law on Friday, July 4th, making permanent most provisions of the 2017 Tax Cuts and Jobs Act (TCJA) and adding several new credits and tax deductions, with some changes effective in 2025 and some in 2026.

This summary highlights many of the key changes that may affect your tax planning for 2025 and beyond. We will follow up with a deeper dive into some of the most important provisions.

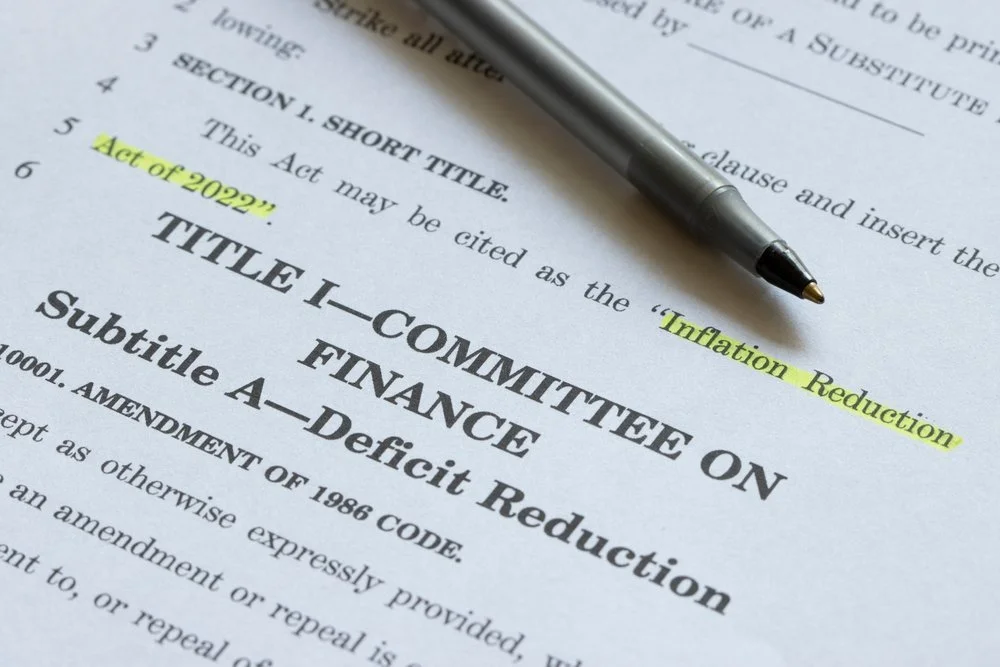

Inflation Reduction Act of 2022 Part 1

This summary is the first of a three-part series on the provisions in the recently passed Inflation Reduction Act of 2022 (IRA). The IRA created or extended many healthcare- and energy-related tax credits that will be “paid for” by higher taxes on some publicly traded corporations and taxes collected from increased IRS enforcement activities. The second installment of our series will cover energy tax credits other than vehicle credits. The third part will describe the new and expanded tax credits for electric vehicles.